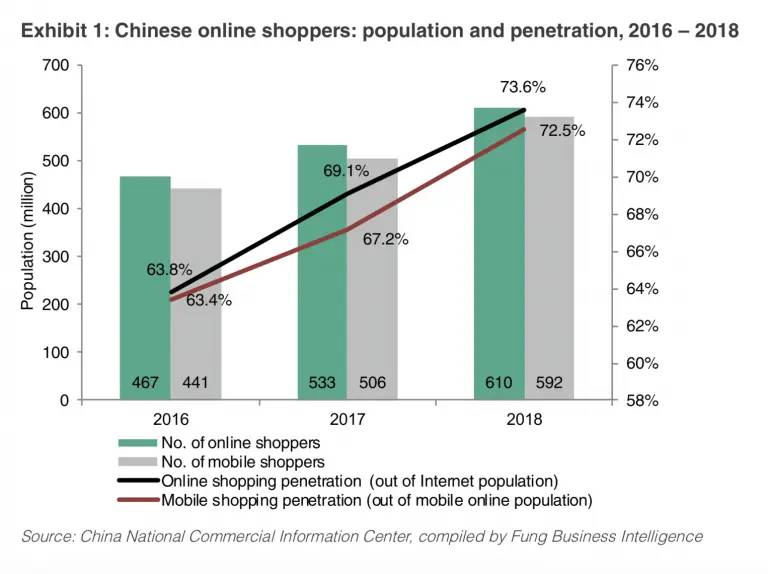

Buying and selling on social media apps have become commonplace in China. Moreover, the use of social media in the context of e-commerce is gaining traction in China. The booming mobile generations and accelerated growth of social media usage are fuelling the growth of social commerce. Chinese consumers are highly mobile and highly social, making them a vast and unique market. They use mobile phones for every aspect of life and rely on social media platforms to discover brands and review products. The behavior of the younger generation is only pushing this trend forward.

According to Analysis, 89% of Chinese consumers born after 1990 will share their purchase experience online. With ecommerce firmly established as an integral part of China’s highly competitive retail scene, businesses are now looking to social commerce to fuel their next phase of growth. According to the Internet Society of China’s recent forecast, the segment is poised to comprise more than 30% of the country’s entire online retail business in 2020 and today we answered 4 common questions about Chinese social commerce landscape.

Social media becomes a popular marketing and sales channel. In today’s digital era, traditional way of marketing and selling can no longer capture the attention of the “post-90s” and “post-00s” generations – who are the most promising consumer segments in China. Increasing numbers of brands and retailers are using social media to market and sell their products. “Chinese shopping habits differ from the rest of the world, due to the tremendous reach of ecommerce and high penetration rates of social media. With unique functions such as Key Opinion Leader (KOL) live-streaming, social activations, content sharing and referral selling, social commerce is challenging the status quo of traditional commerce,” said Patrick Xu, CEO of WPP China. Currently, there are three major types of social commerce platforms in China, each adopting different business models – content-sharing platforms, membership-based platforms, and team purchase platforms.

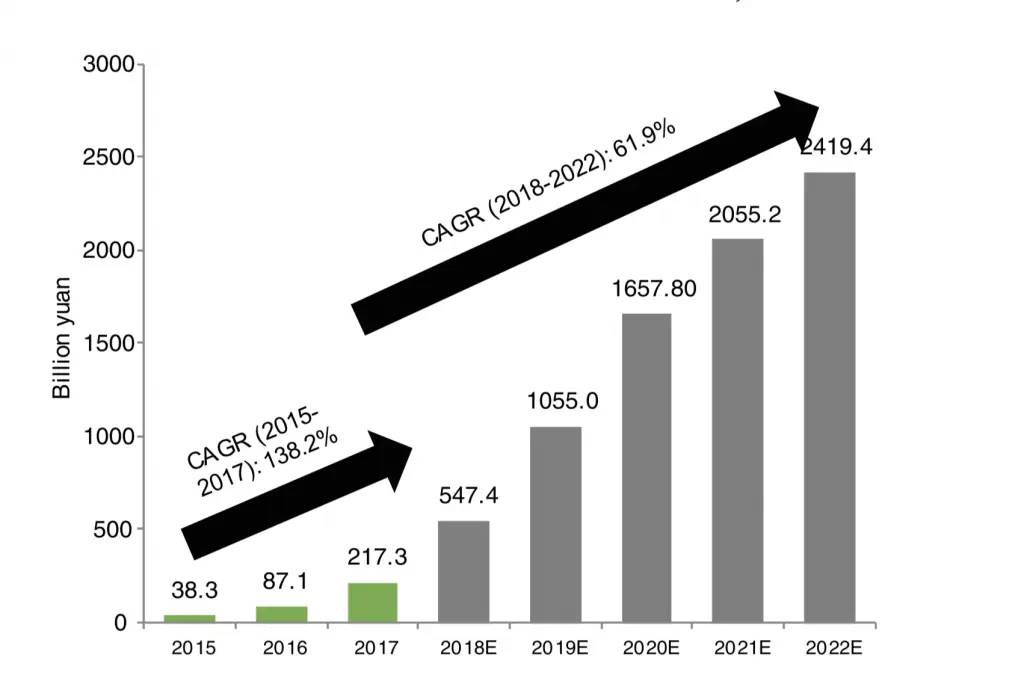

Social commerce is becoming the next disruptive force in China’s ecommerce scene. According to iiMedia Research, China’s social commerce market grew at a compound annual growth rate (CAGR) of 138.2% from 2015 to 2017, and reached more than 547.4 billion yuan in 2018 and further to 2,419.4 billion yuan in 2022. Social e-commerce is thriving now in China. The 5Cs of social e-commerce are content, customer voice, convenience, conversion, conversation and commerce. Moreover, the number of e-commerce users in China has reached 650 million and they average an annual spend of 6,104 RMB each. The huge growth potential of the social commerce sector in China has drawn the attention of investors. According to Ebrun, the sector attracted over 2 billion yuan of financing in 1H19. That’s why brands need to find more efficient ways to connect with consumers. A strategic approach using data and technology would allow them to tap into the full benefits of social commerce.

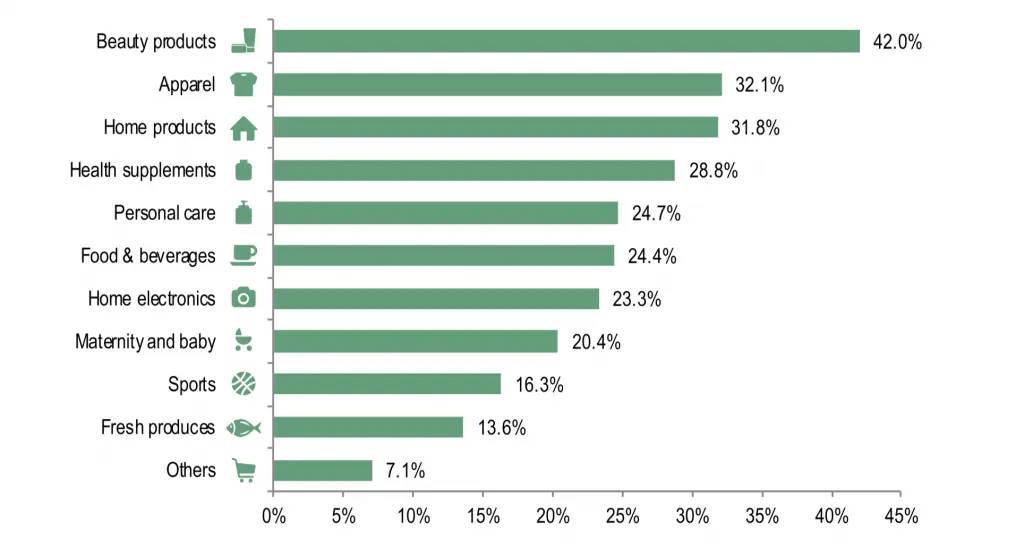

Who shop the most on social commerce platforms? What are the most popular items sold on these platforms? Young consumers, particularly those aged below 25, i.e. those born after 1990s and consumers aged 25-30 are the key consumer groups shopping on social commerce platforms, according to FBIGroup. They are known as the “now” consumers ‐ shoppers who are quick to browse, bookmark products and buy. Chinese millennials – and Gen Z more – today are better informed and feel more empowered about their purchase decisions. Today’s consumers are more trusting of knowledge that is self-sourced, especially those based on other users’ reviews. It means new ways of interaction.

This same group is highly influenced by internet celebrities and “wanghong market products” and even develop their own brands. Increasingly often, they’re using live streaming video to sell products on social media platforms. The “now” consumer follows trends and has unplanned brand experiences and retail interactions. They can be shopping while at home, at work, on the go, or just before bedtime. In fact, it is this behaviour that is driving the need for new approaches to planning social commerce. In terms of the most popular items sought after by social commerce shoppers, beauty products came first (42.0%), followed by apparel (32.1%) and home products (31.8%), reported iiMedia.

4. Marketing: Which implications for brands?

Social commerce has literally revolutionized consumers’ purchase journey opening up huge business potential. Social commerce isn’t just beginning, is a reality now in China. social commerce is set to flourish in China given the high penetration of Internet access via mobile devices and the wide acceptance of online shopping among Chinese consumers. Brands and e-commerce platforms can stay on trend by creating predictive, prescriptive and personalized experiences for their consumers. They can do so by blending social media and shopping, tracking lifetime customer relationships, and using big data to target specific markets with content and products suited to their taste profiles.

The rise of content-sharing platforms, in particular, provides a new channel for everyone – consumers or KOLs – to share travelling and styling tips, recommend products and even sell products through the embedded links. This revolutionizes the entire purchase journey of consumers. To keep pace with the rapidly evolving China market, brands and retailers need to constantly review their sales and marketing strategies and cope with the new needs of the digital era. That’s why traditional way of marketing and selling is no longer be able to capture the attention of the “post-90s” and “post- 00s” generations – who are the key consumer segments in China today.

Front Cover Image By © 2020 The Business of Fashion

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |