The pandemic outbreak has profoundly challenged existing ways of doing business. Economists have already predicted grim outlooks for growth in the first half of 2020 around the globe. What about China? In April 2020, the World Bank forecast a sobering drop in growth to 2.3% in China in its baseline scenario, and slipping to 0.1% in a worst-case scenario, compared to the 6.1% growth in 2019 that was then the lowest in nearly three decades. But today Chinese economy is now getting back on its feet.

“Chinese economic recovery continued in May with consumer spending, manufacturing and investment all bouncing back strongly and the COVID-19 pandemic largely under control, despite new outbreak in Beijing”, said Andy Rothman, investment strategist at San Francisco-based investment firm Matthews Asia. Noting that businesses in China have gradually been opening and life is starting to return to normal, Rothman said the recovery of sales of autos and homes in May reflected that “middle-class and wealthy consumers have both sufficient money and enough confidence in the future to spend it.”

The situation is in constant flux, as known unknowns and unknown unknowns drive novel challenges and uncertainty to levels that have not been seen in generations. According to European Businesses in China latest survey, released by the European Union Chamber of Commerce in China and the global consultancy firm Roland Berger, this has left companies, as one member put it, “not moving towards the light at the end of a tunnel, but feeling your way in the dark for an exit”.

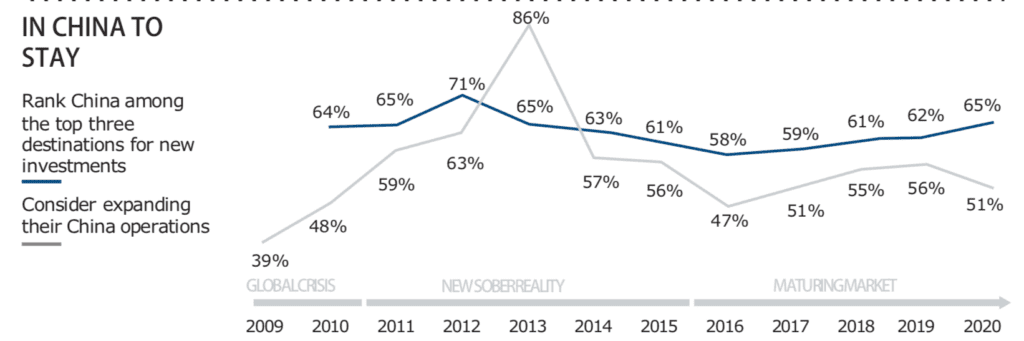

Although Covid-19 has affected small and medium business in China a lot, however only 22% of respondents has pessimistic expectation of opportunities. Moreover China remains a top-three investment destination for 63% of respondents. “Despite the difficult global environment and uncertainties caused by the COVID-19 pandemic, European companies overall remain strongly committed to China,” said Denis Depoux, Global Managing Director of Roland Berger. “European companies are increasingly in China for China, both to meet growing domestic demand and to tap into its innovative ecosystem.”

Even without the COVID-19 outbreak, Beijing is pursuing market’s opening reforms. In July 2019, revisions to the Special Administrative Measures on Access to Foreign Investment, and its equivalent for free trade zones (FTZs), were implemented. A few months later, the Negative List for Market Access was updated. This list defines market access for foreign and domestic businesses, and covers SOEs, private companies, joint-ownership models and wholly foreign-owned enterprises. Some market opening has been noted by 41% of companies and just under half of respondents continue to face market access barriers.

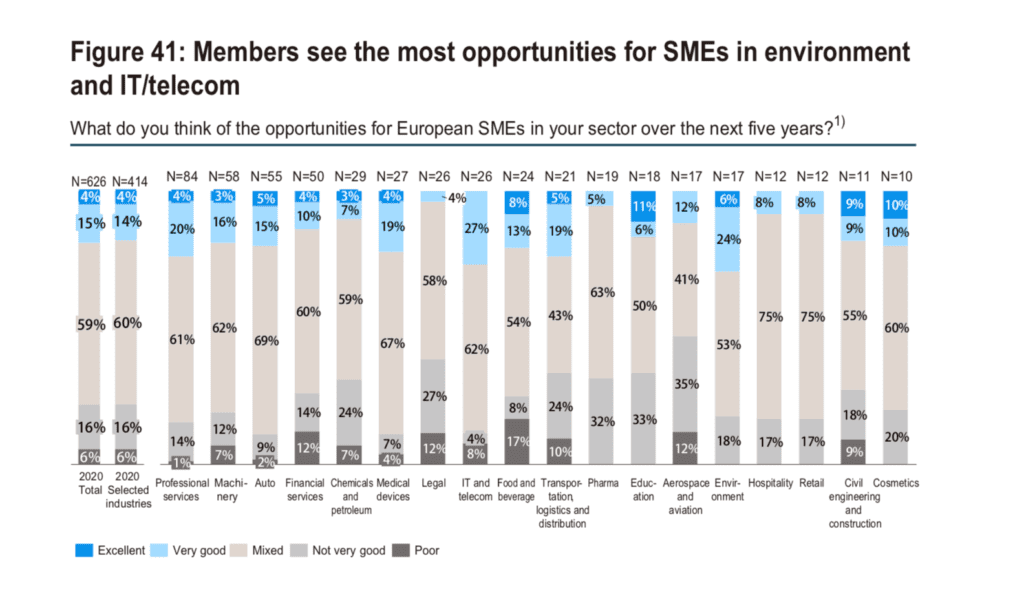

China now has the strength and experience to become a leading force in a global recovery, but this brings with it a significant responsibility. Despite challenges, European SMEs see opportunities in IT and telecom, education, and food and beverage sectors. What is driving this optimism? Without doubt, Chinese consumption. Consumption has taken a hit in China – as it has everywhere else – but the economy is slowly recovering, sales are back and firms are still betting on the secular rise of China’s middle class. Second, Chinese firms have matured becoming leaders in some industries. For the first time, foreigners are buying Chinese technology and industrial assets rather than build from scratch.

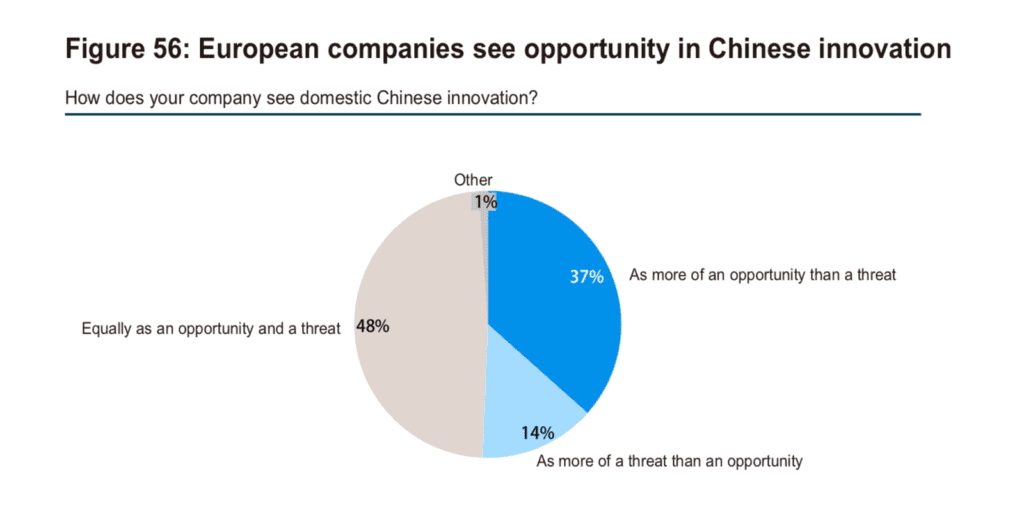

The slowdown of the Chinese economy combined with uncertainty due to the ongoing US-China trade dispute has left its marks, but the majority of respondents are not threatened by competition with their Chinese counterparts; only 14% see domestic Chinese innovation as more of a threat than an opportunity, compared to 37% who identify more the opportunity that it provides.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |